us germany tax treaty protocol

Most importantly for German investors in the United States the Protocol would eliminate the withholding. The Federal Republic of Germany or the United States of America.

Amendments To The Double Tax Treaty Between Ukraine And Switzerland Looking From The Inside And From The Outside Deloitte Ukraine

Protocol to the GermanyUS Double Tax Treaty On June 1 2006 Germany and the United States Contracting States signed a Protocol Protocol to amend the 1989 Germany-US income tax treaty Treaty.

. The United States of America and the Federal Republic of Germany desiring to amend the Convention Between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income and Capital and to Certain Other Taxes and the related Protocol signed at Bonn on. DEPARTMENT OF THE TREASURY THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION SIGNED ON 29TH AUGUST 1989. The proposed anti-abuse provision is uniquely tailored to.

Highlights include elimination of withholding tax on dividends paid by an 80-owned subsidiary to its parent company a new limitation on benefits provision LOB consistent with. The Protocol is one of a few recent US tax agreements to provide for the elimination of the source-country withholding tax on dividends arising from certain direct investments and on dividends paid to pension funds. C If both the decedent and the decedents surviving spouse were domiciled in the United.

The Protocol also provides for mandatory arbitration of. While the US Germany Tax treaty is not the final word on how items of income will be taxed it does help Taxpayers better understand how either the US Government andor Germany will tax certain sources of income. DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE PROTOCOL SIGNED AT BERLIN ON JUNE 1 2006 AMENDING THE CONVENTION BETWEEN.

On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. A the income tax paid or accrued to the Federal Republic of Germany by or on.

Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in order to avoid taxation of US. German Estate and Gift Tax Protocol Author. Technical Explanation Second Protocol.

The US Internal Revenue Service IRS has published guidance regarding the mandatory arbitration procedure contained in the 2006 protocol to the UnitedStates-Germany tax treaty that entered into force on 28 December 2007. Joint Declaration on the Occasion of the June 1 2006 Signing of the Protocol Amending the Convention between The United States of America and The Federal Republic of Germany for. 104 rows The texts of most US income tax treaties in force are available here.

Technical explanation of the Protocol signed at Berlin on June 1 2006 the Protocol amending the Convention between the United States of America and the Federal Republic of Germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes and the related protocol signed at Bonn on. Friday December 11 1998 100918 AM. If both countries ratify the Protocol it will be effective as of January 1 of the year in which the two countries exchange instruments of.

The Protocol Amending the United States-Germany Income Tax Treaty June 1 2006 amends the US-Germany income tax treaty the Treaty which took effect on August 21 1991. Estate and Gift Tax Treaty. Technical explanation of the Protocol signed at Berlin on June 1 2006 the Protocol amending the Convention between the United States of America and the Federal Republic of Germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes and the related protocol signed at Bonn on.

Office of Tax Policy Department of the Treasury Subject. In accordance with the provisions and subject to the limitations of the law of the United States as it may be amended from time to time without changing the general principle hereof the United States shall allow to a resident or citizen of the United States as a credit against the United States tax on income. Joint Declaration on Signing Protocol.

The most important aspect of the Protocol deals with the taxation of cross-border dividend payments. The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts as amended by the Protocol to the German American Treaty generally referred to as the Germany-US. Welcoming the Convention Deputy Secretary Kimmitt said The signing of the Protocol today reflects the cooperation and close economic ties between the United States and Germany.

If the treaty does not cover a particular kind of income or if there is no treaty between your country and the United States. Strong measures to prevent treaty shopping The United States branch tax prohibited under the existing convention will be imposed on United States branches of German corporations for taxable years beginning on or after January 1 1991. The Convention is also an important.

Joint Declaration regarding the June 1 2006 signing of the Protocol Amending the US-German Income Tax Treaty Author. Kimmitt and Barbara Hendricks Parliamentary Secretary of State for the German Ministry of Finance have signed a new Protocol to amend the existing bilateral income tax treaty concluded in 1989 between the two countries. Estate and Gift Tax.

Office of Tax Policy US. Convention US and Germany Taxation Estates and Gifts November 22 2006. The 2006 protocol modified certain provisions of the tax treaty.

Convention US and Germany Taxation Income Cap Gains and Other signed June 1 2006. The Protocol signed at Berlin on June 1 2006 amended Article 26 of the Tax Treaty between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes. Protocol Amending the Convention Between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income and Capital and to Certain Other Taxes Signed on August 29 1989 signed at Berlin June 1 2006 the Protocol along with a related Joint.

This is a technical explanation of the Protocol signed at Washington on December 14 1998 the Protocol which amends the Convention Between the United States Of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts signed at Bonn on December 3 1980 the. The Protocol also modernizes our treaty relationship in several ways and brings it into closer conformity with current US. The US Treasury Department announced last Thursday that Deputy Secretary Robert M.

The guidance is contained in IRS Announcement 2008-39.

Protocol Amending The Convention For The Protection Of Individuals With Regard To Automatic Processing Of Personal Data Council Of Europe Treaty Series No 223

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Kyoto Protocol 10 Years Of The World S First Climate Change Treaty

Should The United States Terminate Its Tax Treaty With Russia

Reflections On The Recently Signed Amendment Protocol To The Dutch German Tax Treaty Insights Dla Piper Global Law Firm

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Luxembourg Protocol To The Double Tax Treaty With Russia Has Entered Into Force Ey Luxembourg

Protocol Amending The Convention For The Protection Of Individuals With Regard To Automatic Processing Of Personal Data Council Of Europe Treaty Series No 223

Madrid Protocol Countries Covered For Trademark Registration

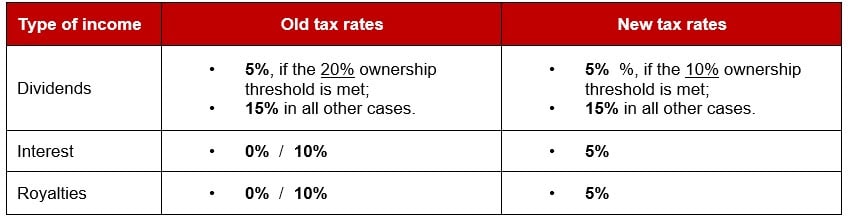

The Protocol Amending The Ukraine Switzerland Double Tax Treaty Entered Into Force

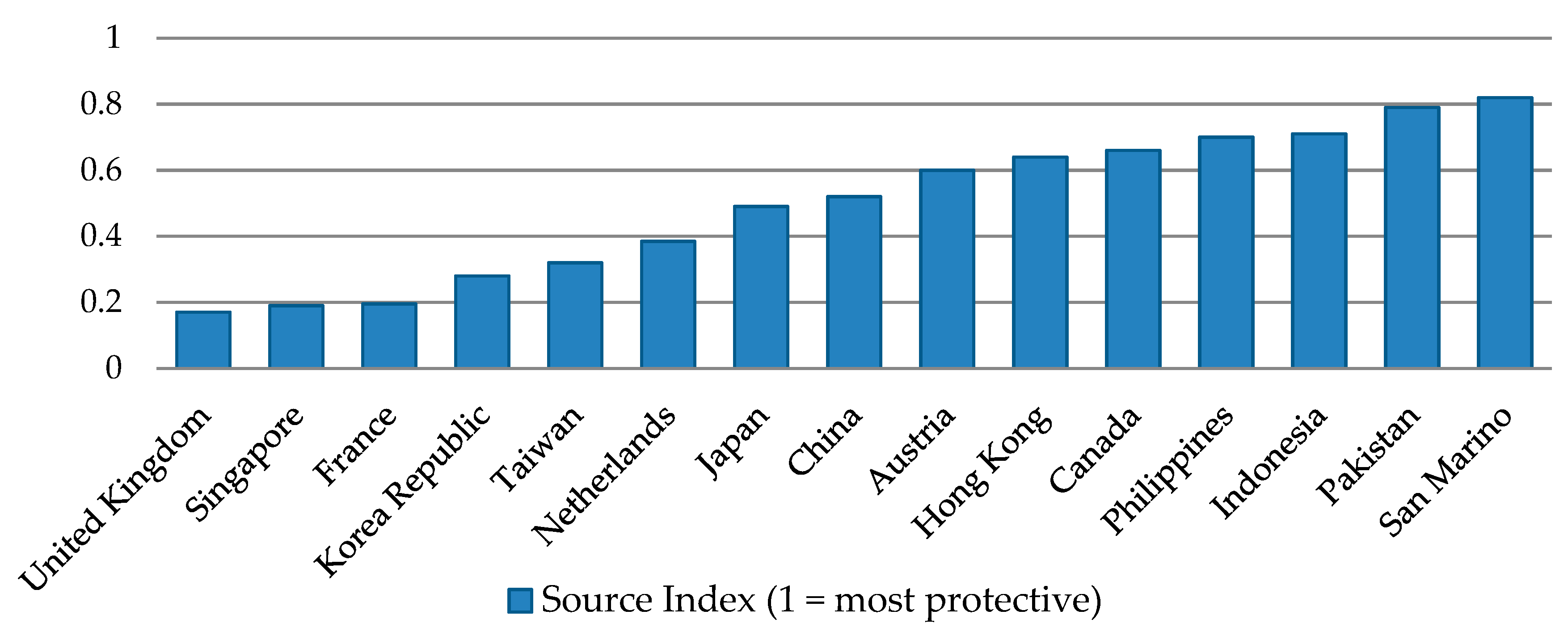

All Rights Reserved Review Of Tax Treaty Policy 1 A Review Of Indian Tax Treaty Policy Comparing Indian Tax Treaties With Oecd And Un Models January Ppt Download

Reflections On The Recently Signed Amendment Protocol To The Dutch German Tax Treaty Insights Dla Piper Global Law Firm

Preliminary Briefing Kuwait Switzerland Netherlands And Luxembourg Ppt Download

United States Bulgaria Tax Treaty